DEBT

by poppyfei

This work has not been commented by curators.

Title

DEBT

Headline

Debt

Concept author(s)

Xiao FAN

Concept author year(s) of birth

1988

Concept author(s) contribution

。

Concept author(s) Country

China

Friendly Competition

Competition category

Visual communication practice

Competition subcategory

static

Competition field

academic

Competition subfield

student

Subfield description

Griffith/QCA/VCD

Check out the Debt. 2012 outlines of Memefest Friendly competition.

Description of idea

Describe your idea and concept of your work in relation to the festival outlines:

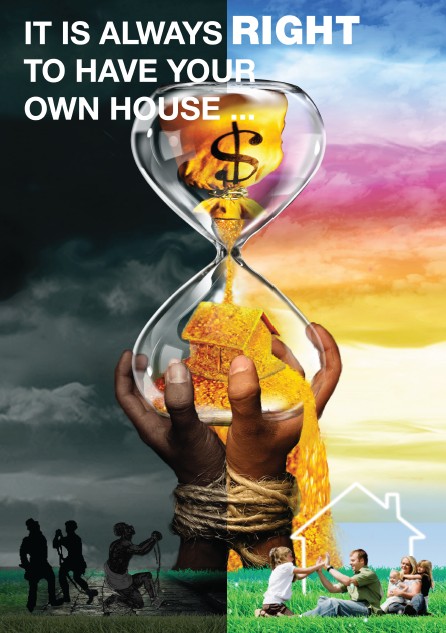

China current economic development has been more quickly, so from the needs of the development of the enterprise to see it to expand production and sales will need loans to support. And personal debt demand is mainly the house buyers demand. This demand is owner-occupied and investment more reasons. As the China development of people’s living standards greatly improved, so is preferred to improve housing, people feel that it is important to have your own house, the house needs very much. Because house has been in the price for a few years, so there are many speculative buying, leading to the current price virtual high. When we have a certain amount of stability and income, we can buy the house and car by debt, which is ahead of an advance in the future and improving the present life. If you do better, equivalent high buy low price hone buyers, it was doing investment business.

Loan can bring different impacts to people's lives. money and debt can be good or bad, the key is how people manage them. When the property you purchased has increased its value which outweighs the sacrifice you have paid such as your time and money, the quality of your would improve. However, if the debt (loan) is not dealt well by the owner, more pressure will be brought to your family.

According to stat and figures from central bank of china, the additional 84.1 billions bank loan, mostly comes from individual housing, consumer credit and medium to long-term loans. To be more precise, financial institutions increased the individual housing loan by 16.1 billion, loan on consumption and study increased by 12.5 billion,In fact, this situation would remain rising up in terms of the entire year analysis. From January to October, the loan on individual housing and consumption has accumulated to 194.9 billion, 124.6 billion more than same period in last year, shared the 41% of additional loan by financial institutions. In other word, 40% of the new loan is for individual housing and consumption purposes.

From China financial institutions perspective, this change is not only realize the adjustment of loan structure, but also indicates the improvement on loan quality.

In the past, financial institutions chancily issue loan for individual, clients always be the enterprises, and most of those are all national-owned, when these enterprises are in dilemma, recovery of loan is difficult, this is also the main issue that national –owned bank always remain poor loan quality.

The growth of personal loans will provide the bank an opportunity to deal with high quality client. Compare with the national-owned enterprises condition, when individual obtains loan from bank and cannot repay it on time, he or she is unlikely to default. For example, rural credit cooperatives, which aim to issue loan to farmers, rarely default because of the personal loan. Also, housing loan is always to be a relatively stable part in terms of experiences overseas. According to ICBC’s data, the rate of breach on consumption is only 0.1%, which is quite low.

The rapid Growth on personal consumption loan will not only shows the changes on consumption among Chinese, more importantly, it indicates that people are optimistic about the prospect of national economy. If everyone is not confident about future Macro economy, personal income will not expected to be ideal, and worried about borrowing. However, the financial institution should also hold a certain degree of cautious on personal consumption loan, because an effective personal credit system is still on the way, there is also a need on strengthen control of credit risk. Nerveless. Nothing can change that the era of personal consumption loan is approaching.

Now the average income for most of Chinese is 2000-5000 RMB/mth, their pressure from loan will be relatively high. For example, a couple now wants to sell their old house (approximately 40 square meters) to buy a new one (approximately 60 square meters), so they need a first payment, totally their income can be around 3000 RMB,

8-year mortgage, every month they must pay 1000, much more pressures will bring by baby, at that time the baby just comes out, the monthly expense will be around 1000, then in the following 1 year, 800 on milk power (baby always needs the best!), Normally this couple will spend 400-600 on food, other expense such as electricity, water, network cost about 400, after these, only 400 left, and they can not get rid of emergency, such as friend wedding, and they can not be sick, because it is not affordable by them, they do not have any deposit. Not everyone can reimburse his or her expense on medicals, and the government seldom set a fund for such function. So the pressure brings by loan is extremely high in China, it is so common that people suicide because they are not able to make loan repayment.

What kind of communication approach do you use?

Poster

What are in your opinion concrete benefits to the society because of your communication?

home loan is a way of having your house in advance of you actually owning the money to afford it. At the same time, if the value of the property increased after you purchase it, it would be a wise investment. On the other hand, if the interest rate is too high that the customers can't afford it, the pressure will be overwhelming to them. I used the comparison to present my form of debt and loan that it like the sand in the sandglass, it is just a matter of time running out. When the sand can't run smoothly, the Debtor would be like slave suffering from paying back. When it all runs out, the families benefit from it and the debtors turn into owners who gain the freedom of using the house which, normally, make their families live better and happier.

What did you personally learn from creating your submitted work?

The concept of the loan is completely different between western countries and Chinese. Western countries are promoting the loans, also believe that the debt is a good thing which will make life easier. But the Chinese people consider that the debt will only make life more difficult and make the greater pressure.

Why is your work, GOOD communication WORK?

Contrast the cultural differences between China and Western Countries.

Where and how do you intent do implement your work?

Bus station

Did your intervention had an effect on other Media. If yes, describe the effect? (Has other media reported on it- how? Were you able to change other media with your work- how?)

Make the poster more clearly about cultural differences between in the China and foreign.